Credit scores explained at “Money Talks”

April 28, 2016

A new “Money Talks” presentation from ¢hange Matters focused on building credit.

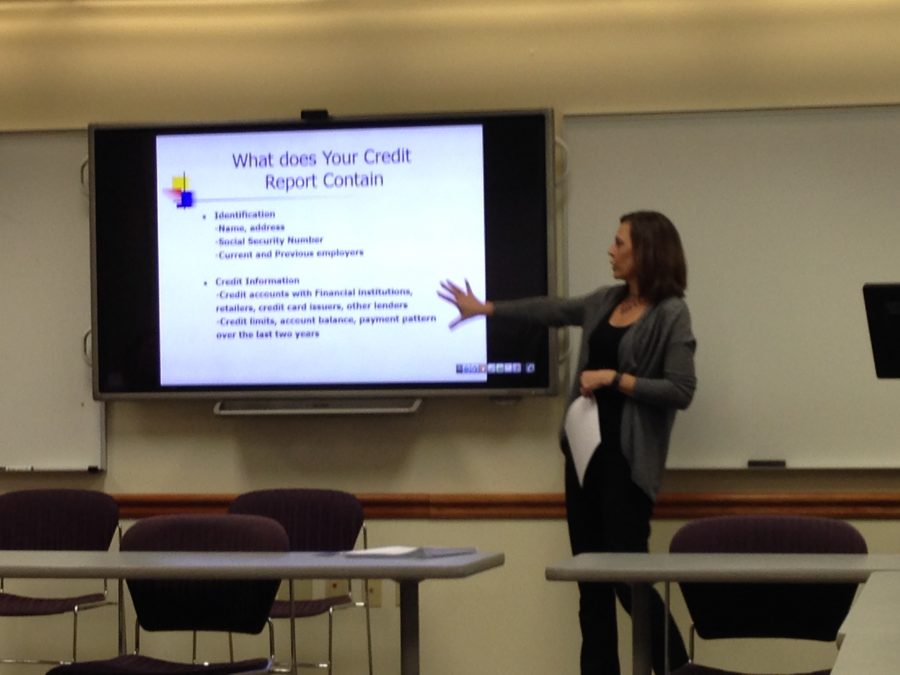

The talk took place on April 21 in Laun 210. Fond du Lac Program Director Tammy Matzdorf, from Consumer Credit Counseling Service, taught attendees of the open-to-everyone event how to improve their credit score.

Matzdorf first showed attendees how to see their credit report from agencies like Experian, Equifax and TransUnion. Afterward, she demonstrated the concept of a credit score, which she illustrated as a number that shows an estimate of one’s “financial creditworthiness.”

Matzdorf explained that credit scores are based on one’s payment history, indebtedness and new and old credit. Scores range from 300 to 850, but Matzdorf suggested that a score of 720 or higher is ideal.

She noted that credit scores help lenders predict one’s likelihood to make credit payments on time, which in turn affects whether you can get more credit or pay lower interest rates.

After knocking out some myths about credit scores including the notions that one should close unused credit cards and that checking your credit score hurts it, Matzdorf explained how to raise a credit score. She advised attendees to pay their bills on time, keep their old accounts open and only apply for new credit when absolutely necessary.

“If you go to the annual credit report or directly to [Experian, Equifax or TransUnion], you can run your own credit report as many times as you want, but if you go to your credit union and have them do it, or if you apply for a loan or a credit card, any time someone else pulls it to make a decision about giving you credit, it can impact the score, so we don’t want to apply unless we really have to,” Matzdorf said.

The presentation was the second in the “Money Talks” lecture series from ¢hange Matters, a new club focused on finances advised by Assistant Director of Financial Aid Laura Lange.